تاريخ الرياضيات

تاريخ الرياضيات

الرياضيات في الحضارات المختلفة

الرياضيات في الحضارات المختلفة

الرياضيات المتقطعة

الرياضيات المتقطعة

الجبر

الجبر

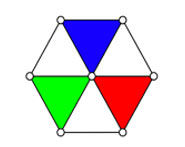

الهندسة

الهندسة

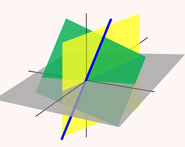

المعادلات التفاضلية و التكاملية

المعادلات التفاضلية و التكاملية

التحليل

التحليل

علماء الرياضيات

علماء الرياضيات |

Read More

Date: 16-8-2021

Date: 5-11-2021

Date: 22-9-2021

|

Suppose you have finished 3 years’ payment on a 5-year loan of $9,952 at 8% annual interest, for a car. As we saw in Sample Problem 1.3in(Compound Interest Loans and Payments), your payments were $200 per month.

Think about the remaining 24 months. Your situation is as though you had just taken a loan of $A at 8% per annum, where

A(151/150)24/150 = 200[(151/150) 24−1],

so 1.17288A = 150×200×0.17288, A = 4,421.94.

We say your equity in the loan is $9,952 - $4,421.94 , about $5,530.

You might think that, after making payments for three-fifths of the payment period, you would own 60% of your car. However your equity is a little less than that amount: around 55.5%.

The difference is much greater on longer-term loans. For example, suppose you take out a 30-year house loan for $100,000 at 8% per annum, with equal monthly payments of $733.76 (as we calculated above). After three-quarters of the term— 270 of the 360 payments have been made—it is as if you had just taken a loan at 8% per annum with principal $A, where

A(151/150)90/150 = 733.76[(151/150)90−1],

that is

A×.012123295= 600.578

so A = 49,539.20 and your equity is $50,460.80.

After three-quarters of your payments, you own about half of your house.

|

|

|

|

علامات بسيطة في جسدك قد تنذر بمرض "قاتل"

|

|

|

|

|

|

|

أول صور ثلاثية الأبعاد للغدة الزعترية البشرية

|

|

|

|

|

|

|

مكتبة أمّ البنين النسويّة تصدر العدد 212 من مجلّة رياض الزهراء (عليها السلام)

|

|

|