تاريخ الرياضيات

الاعداد و نظريتها

تاريخ التحليل

تار يخ الجبر

الهندسة و التبلوجي

الرياضيات في الحضارات المختلفة

العربية

اليونانية

البابلية

الصينية

المايا

المصرية

الهندية

الرياضيات المتقطعة

المنطق

اسس الرياضيات

فلسفة الرياضيات

مواضيع عامة في المنطق

الجبر

الجبر الخطي

الجبر المجرد

الجبر البولياني

مواضيع عامة في الجبر

الضبابية

نظرية المجموعات

نظرية الزمر

نظرية الحلقات والحقول

نظرية الاعداد

نظرية الفئات

حساب المتجهات

المتتاليات-المتسلسلات

المصفوفات و نظريتها

المثلثات

الهندسة

الهندسة المستوية

الهندسة غير المستوية

مواضيع عامة في الهندسة

التفاضل و التكامل

المعادلات التفاضلية و التكاملية

معادلات تفاضلية

معادلات تكاملية

مواضيع عامة في المعادلات

التحليل

التحليل العددي

التحليل العقدي

التحليل الدالي

مواضيع عامة في التحليل

التحليل الحقيقي

التبلوجيا

نظرية الالعاب

الاحتمالات و الاحصاء

نظرية التحكم

بحوث العمليات

نظرية الكم

الشفرات

الرياضيات التطبيقية

نظريات ومبرهنات

علماء الرياضيات

500AD

500-1499

1000to1499

1500to1599

1600to1649

1650to1699

1700to1749

1750to1779

1780to1799

1800to1819

1820to1829

1830to1839

1840to1849

1850to1859

1860to1864

1865to1869

1870to1874

1875to1879

1880to1884

1885to1889

1890to1894

1895to1899

1900to1904

1905to1909

1910to1914

1915to1919

1920to1924

1925to1929

1930to1939

1940to the present

علماء الرياضيات

الرياضيات في العلوم الاخرى

بحوث و اطاريح جامعية

هل تعلم

طرائق التدريس

الرياضيات العامة

نظرية البيان

Interest Periods

المؤلف:

W.D. Wallis

المصدر:

Mathematics in the Real World

الجزء والصفحة:

209-211

15-2-2016

2021

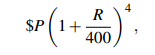

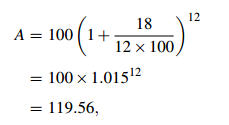

Very often a bank pays interest more frequently than once a year. Say you invest at R% per annum for 1 year but interest is paid four times per year. The bank pays R /4 % every 3 months; this is called the interest period, or term. (Unfortunately, term is also used to denote the life of the loan.) If you invest $A, your capital after a year is

just as if the interest rate was divided by 4 and the number of years was multiplied by 4.

(Notice that we used the simplifying assumption that 3 months is a quarter of a year. In fact some quarters can be 92 days, others 91 or 90, but banks seldom take this into account. Similarly, when interest is calculated every month, it is usual to assume that each month is one-twelfth of a year.)

Sample Problem 1.1 Say your bank pays R = 8% annual interest, and interest is paid four times per year. What interest rate, compounded annually, would give you the same return?

Solution.(1+ R/400 )4 = (1.02)4 = 1.0824... so the effect is the same as compounding annually with 8.24...% interest rate.

Say interest is added t times per year. The result after 1 year is the same as if the interest rate were (R/t)% and the investment had been held for t years: after 1 year,

The calculations are exactly the same when you borrow money as they are when you invest money.

Sample Problem 1.2 You borrow $50,000 at 10% annual interest, compounded every 3 months, for 10 years. Assuming you make no payments until the end of the period, how much will you owe (to the nearest dollar)?

Solution. We have P = 50,000, R = 10, t = 4 and N = 10. So

which comes to 134,253.19... and you owe $134,253.

In Sample Problem 1.1, 8% is called the nominal rate of interest. The nominal rate doesn’t tell you how often compounding takes place. 8.24. . . % per annum is the effective rate. (These terms are established in the Truth in Savings Act.)

Sometimes banks and other lenders will talk about nominal rates per month or per quarter, but we shall always use these terms for the annual rates unless we specify otherwise.

When discussing a loan, the annual nominal rate is also called the annual percentage rate or APR. The yearly effective rate is called the annual percentage yield (APY) or effective annual rate (EAR). To avoid confusion, we shall refer to the APY, both for investments and loans.

Banks and other lenders like to tell you the APR, but what you really want to know is the APY. To calculate the APY, one works out how much would be owed on $100 at the end of a year, if no payments were made. This is not a real-world calculation: credit card companies and mortgage-holders normally require some minimum payment, or a penalty is charged. In calculating the APY, act as though all penalties are waived.

Sample Problem 1.3 Your credit card company charges an APR of 18%.

Payments are required monthly, and interest is charged each month. What is the corresponding APY?

Solution. The amount owing from a $100 loan at the end of 1 year is

so the APY is 19.56%.

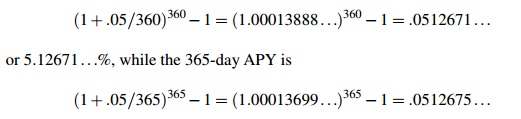

We said earlier that it is usual to use the 360-day “standard” year instead of the more accurate 365-day model. To conclude this chapter we show that this does not make a great deal of difference. Suppose you were to borrow money at the rate of 5%, compounded daily. If a 360-day year is used, the APY is

or 5.12677...%. If you borrow $10,000 and repay your loan after a year, you will owe between $10,512.67 and $10,512.68. The difference is less than one cent. And, in the real world, your debt would probably be rounded to the nearest dollar.

الاكثر قراءة في الرياضيات في العلوم الاخرى

الاكثر قراءة في الرياضيات في العلوم الاخرى

اخر الاخبار

اخر الاخبار

اخبار العتبة العباسية المقدسة

الآخبار الصحية

قسم الشؤون الفكرية يصدر كتاباً يوثق تاريخ السدانة في العتبة العباسية المقدسة

قسم الشؤون الفكرية يصدر كتاباً يوثق تاريخ السدانة في العتبة العباسية المقدسة "المهمة".. إصدار قصصي يوثّق القصص الفائزة في مسابقة فتوى الدفاع المقدسة للقصة القصيرة

"المهمة".. إصدار قصصي يوثّق القصص الفائزة في مسابقة فتوى الدفاع المقدسة للقصة القصيرة (نوافذ).. إصدار أدبي يوثق القصص الفائزة في مسابقة الإمام العسكري (عليه السلام)

(نوافذ).. إصدار أدبي يوثق القصص الفائزة في مسابقة الإمام العسكري (عليه السلام)